Schnauzers are beloved for their intelligence, loyalty, and spirited personalities. However, their unique health needs require proactive care—and the right pet insurance. This guide covers everything Schnauzer owners in the US and Europe need to know about securing optimal coverage.

Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

Why Schnauzers Need Specialized Insurance

Schnauzers, including Miniature, Standard, and Giant varieties, are prone to breed-specific health issues:Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

- Skin conditions (e.g., Schnauzer comedone syndrome).

- Eye problems (cataracts, progressive retinal atrophy).

- Pancreatitis and bladder stones.

- Hip dysplasia (common in Giants).

Insurance helps manage unpredictable veterinary costs, ensuring your dog receives timely care without financial strain.Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

Key Coverage Considerations for Schnauzers

1. Breed-Specific Health Risks

Ensure your policy covers:Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

- Hereditary conditions (e.g., genetic eye disorders).

- Chronic illnesses (diabetes, allergies).

- Preventive care (optional add-ons for vaccinations, dental cleanings).

Tip: Review exclusions carefully—some insurers exclude pre-existing conditions or age-related ailments.Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

2. Age and Enrollment Timing

- Enroll your Schnauzer early (ideally as a puppy) to avoid pre-existing condition clauses.

- Older dogs (7+ years) may face higher premiums or limited coverage options.

3. Geographic Factors

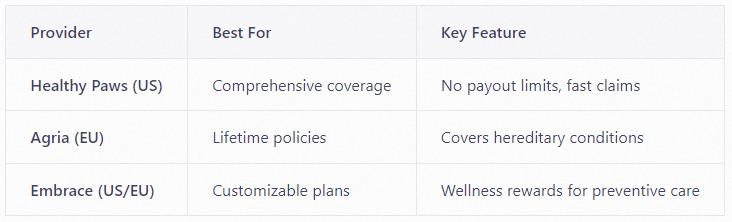

- US Plans: Compare providers like Healthy Paws, Embrace, or Trupanion.

- European Plans: Consider providers like Agria (UK), Bought By Many (EU), or Petplan.

- Check for regional coverage limits or travel benefits if you move frequently.

How to Compare Insurance Providers

1. Coverage Flexibility

Look for:Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

- Customizable deductibles ($100–$1,000).

- Reimbursement rates (70%–100%).

- Annual/lifetime payout limits (avoid capped policies for chronic conditions).

2. Customer Support & Reputation

- Read reviews for claim processing speed and transparency.

- Verify 24/7 vet helpline access (critical for emergencies).

3. Cost vs. Value

- Average US Cost: $30–$70/month.

- Average EU Cost: €20–€60/month.

- Higher premiums often reflect broader coverage for breed-specific risks.

Top Recommended Insurers for Schnauzers

Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

Tips to Save on Schnauzer Insurance

1. Bundle Policies: Some insurers offer discounts for multiple pets.Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

2. Annual Payment: Save 5%–10% by paying upfront.Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

3. Higher Deductibles: Lower monthly costs if you can afford out-of-pocket emergencies.Article source:https://www.petwoah.com/Pet Site-https://www.petwoah.com/974.html

Final Checklist Before Enrolling

✅ Verify coverage for breed-specific conditions.

✅ Confirm reimbursement rates and deductible options.

✅ Check waiting periods (typically 14–30 days).

Protecting your Schnauzer with the right insurance ensures they live a happy, healthy life. By prioritizing breed-specific coverage and comparing trusted providers, you’ll avoid financial stress and focus on what matters—enjoying time with your furry companion.